Funny thing. As it turns out, when the cost of one of the basic necessities of life, i.e. shelter, triples and quadruples within a few short years, the rest of the economy is impacted as well.

Countrywide Financial, the nation’s largest mortgage lender, said yesterday that more borrowers with good credit were falling behind on their loans and that the housing market might not begin recovering until 2009 because of a decline in house prices that goes beyond anything experienced in decades.

The news from Countrywide, widely seen as a bellwether for the mortgage market, initiated a sell-off in the stock market, which is at its most volatile in more than a year. The Standard & Poor’s 500-stock index fell 30.53 points, or 2 percent, to 1,511.04, its biggest one-day drop in nearly five months. The dollar dropped to a new low against the euro, edging closer to $1.40 to 1 euro. Stocks opened sharply lower in Japan this morning.

The slumping housing market has become the biggest worry for the stock market, which just four days ago set records, because of its potential impact on the broader economy and financial system.

Countrywide’s stark assessment signaled a critical change in the substance and tenor of how housing executives are publicly describing the market. Just a couple of months ago, some executives were predicting a relatively quick recovery and saying that most home loans would be fine with the exception of those made to borrowers with weak credit who stretched too far financially.

Executives at Countrywide had for some time been more skeptical than others but the bluntness of their comments yesterday surprised many on Wall Street. In a conference call with analysts that lasted three hours, Countrywide’s chairman and chief executive, Angelo R. Mozilo, said home prices were falling “almost like never before, with the exception of the Great Depression.â€

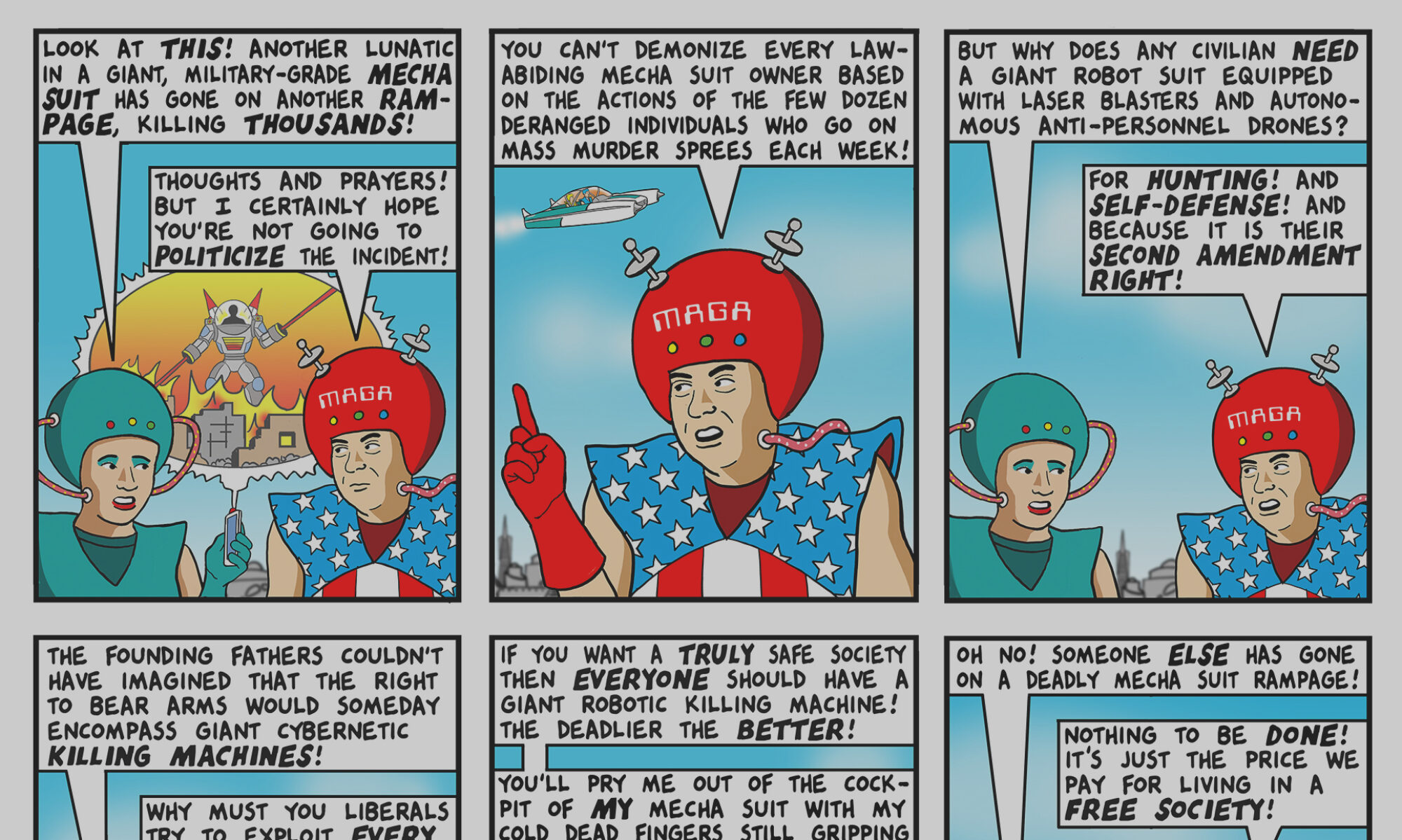

Related cartoon here.